U.S. Special Envoy to Libya, Ambassador Richard Norland, emphasised the importance of successfully implementing the recently reached agreement on the leadership of the Central Bank of Libya.

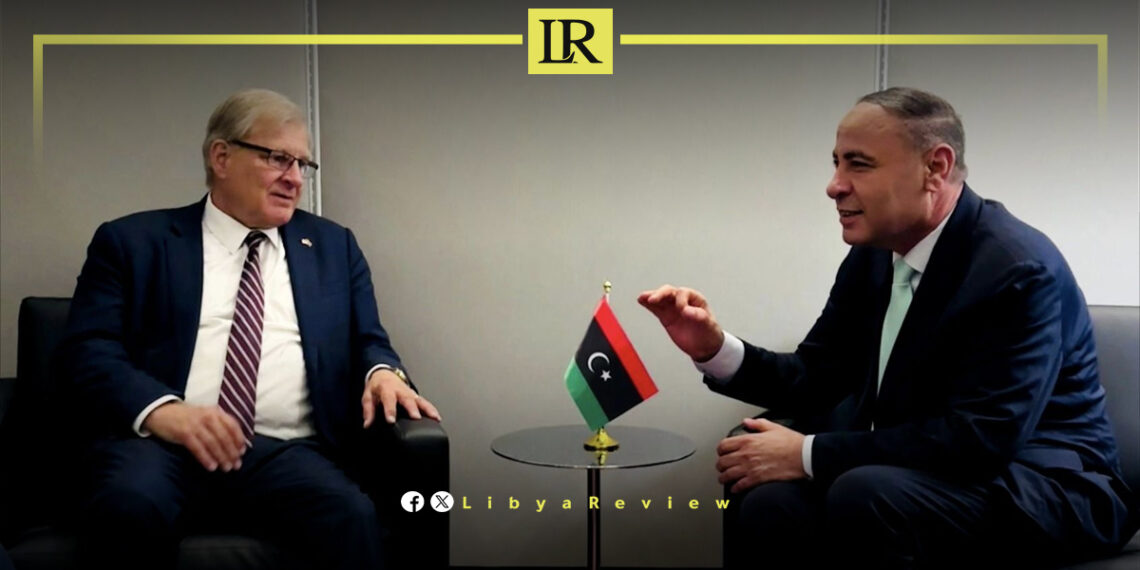

This statement came during his meeting with Libya’s Acting Minister of Foreign Affairs under the Dbaiba government, Taher Al-Baour, on the sidelines of the UN General Assembly in New York.

The meeting was also attended by Joshua Harris, the U.S. Deputy Assistant Secretary of State for Near Eastern Affairs.

Norland stated, “We discussed how the successful implementation of the Central Bank leadership agreement, reached yesterday, could help advance progress in Libya’s political process during a critical time for the country.”

He added that the discussion also touched upon measures to strengthen Libya’s sovereignty amidst escalating regional tensions.

On Thursday, Libya’s political leaders signed a crucial UN-backed agreement aimed at resolving the long-standing crisis at the Central Bank of Libya.

The deal, signed at the UN Support Mission in Libya (UNSMIL) headquarters, sets out a clear plan for appointing new leadership at the bank and restructuring its board of directors. This move is seen as a critical step in restoring stability to Libya’s financial system, which has been deeply affected by years of political fragmentation.

The agreement, signed by representatives from both the House of Representatives and the High Council of State, outlines specific steps to appoint a new governor, deputy governor, and board members for the Central Bank. Here’s a breakdown of the key points included in the seven-point agreement:

Key Provisions of the Central Bank Deal:

1. New Governor and Deputy Governor Appointments:

The agreement nominates Naji Mohammed Issa Belgasem as the new Central Bank governor and Marei Muftah Raheel Al-Barassi as his deputy. The House of Representatives is required to confirm these appointments within one week of the deal being signed, in line with Article 15 of the Libyan Political Agreement.

2. Formation of a New Board of Directors:

Once appointed, the new governor will have two weeks to nominate members of the Central Bank’s board of directors. These nominations must be made in consultation with the legislative authorities and in accordance with Libyan law, specifically the criteria outlined in Annex 1 of the agreement. This restructuring is aimed at ensuring that the bank operates with a more unified and transparent governance system.

3. Suspension of the Ministry of Finance’s Undersecretary:

The role of the Ministry of Finance’s undersecretary on the Central Bank’s board will be suspended under the new framework. This move is designed to reduce political interference and focus on building a more independent and effective board.

4. Limiting the Governor and Deputy’s Powers:

The agreement stipulates that the governor and deputy governor cannot exercise the board’s powers in the absence of its members, as per Article 16 of Law No. 1 of 2005 on banking. This clause is intended to prevent any concentration of power in the hands of the bank’s leadership without proper oversight from the board.

5. Nullification of Conflicting Decisions:

Any previous decisions or actions taken by the Central Bank that conflict with the terms of this agreement or the Libyan Political Agreement will be annulled. This step ensures that past policies or actions that may have contributed to the crisis can be reversed to align with the new framework.

6. International Oversight and Enforcement:

The United Nations Support Mission in Libya (UNSMIL) will work closely with all involved parties to ensure the successful implementation of the agreement. UNSMIL will also assist in canceling any measures or decisions that could hinder the full execution of the deal.

7. Immediate Implementation:

The agreement became binding immediately upon signing, ensuring that the process to reform the Central Bank starts without delay. This swift action is seen as vital to restoring public trust in Libya’s financial institutions and stabilizing the economy.