Libya was ranked fourth in Africa and sixth in the Arab world in terms of the largest gold reserves, according to the Libyan Centre for Index Building.

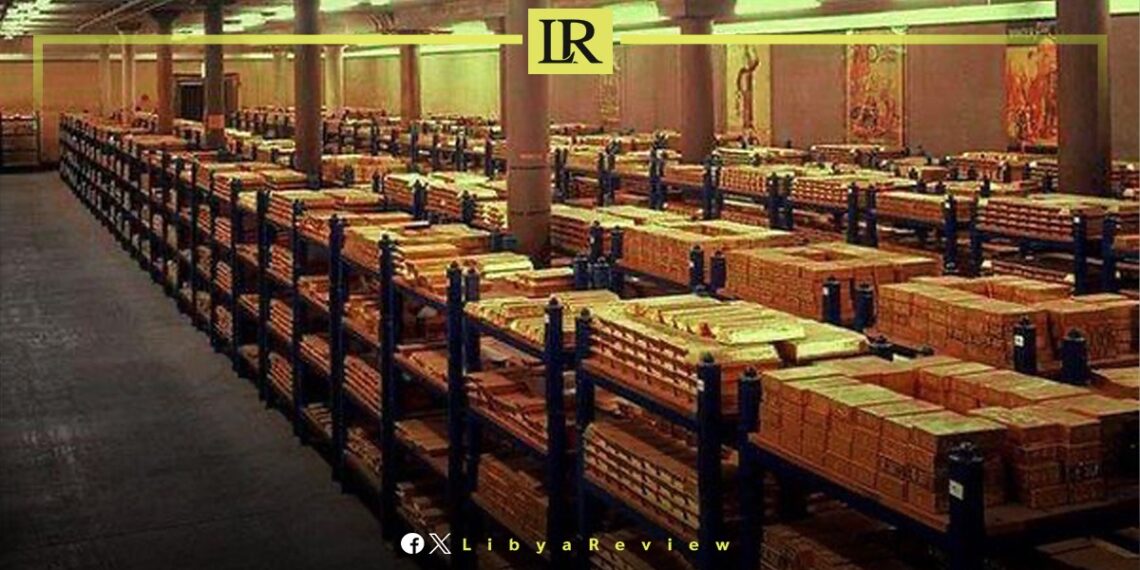

The nation’s gold reserves have reached a substantial total of 116.6 tons, constituting 10.43 percent of the total reserves of the Central Bank of Libya (CBL). Notably, in 2023 alone, Libya’s CBL enhanced its gold holdings by approximately 30 tons.

Algeria is at the top of African countries, with 174 metric tons, followed by South Africa in second place, with 125 metric tons.

The centre stated that African countries have taken important steps to enhance their reserves of gold, which put them in a positive position amid a state of global political and economic instability.

This strategic accumulation of gold underscores Libya’s commitment to fortifying its economic stability and diversifying its asset base beyond the traditional reliance on oil revenues.

In a global context where precious metals are increasingly seen as a hedge against economic uncertainty, Libya’s significant gold reserves position it as a country with promising economic potential.

Libya’s noteworthy ranking in gold reserves among African and Arab nations highlights not only its rich natural resource endowment but also signals the country’s potential to play a more influential role in the regional and global economic arenas.

This development is particularly significant as it aligns with the broader goals of economic recovery and sustainable growth post-conflict, offering a beacon of hope for Libya’s future economic direction.

Last year’s record gold sales were partly due to increased demand for gold from central banks and investors, as global economic conditions stagnated and inflation raised the cost of living.

The World Gold Council (WGC) data also shows a significant change in attitude towards gold, as central banks began selling hundreds of tons of their gold bullion each year in the 1990s and 2000s, particularly in Europe.

The WGC report estimates global gold reserves at 35,494 tons at the end of 2022. However, this may be an underestimate, as many countries do not declare all their holdings. Nevertheless, gold remains a preferred investment for investors around the world, including in Africa, where several countries have significant gold reserves.