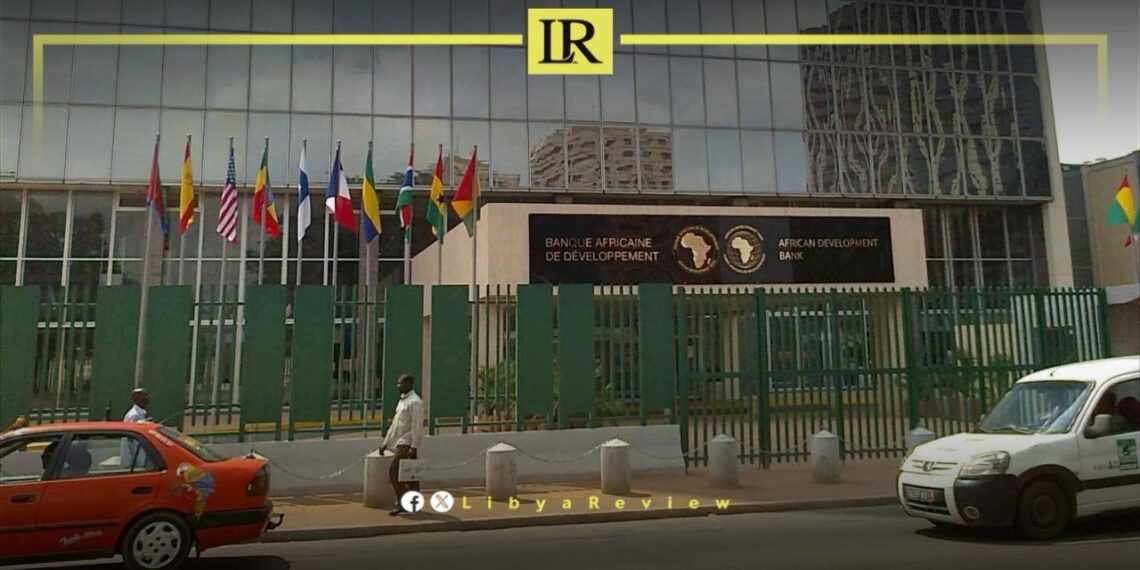

The African Development Bank (AfDB) expected Libyan economy to grow by about 8% in 2024. According to the report, Libya will be among twenty-one African countries experiencing economic growth this year. The African continent will be the fastest-growing after Asia.

The report called for cautious optimism amid global and regional risks, increased geopolitical tensions, and political instability in several African countries.

On Wednesday, operations at the Al-Zawiya refinery and the Mellitah and Misrata oil complexes in Libya were halted by the western Petroleum Facilities Guard (PFG). The shutdown was reportedly due to the group’s demands for unpaid wages and benefits.

The PFG released a video statement demanding that their grievances be addressed within five days to avoid further disruptions across Libya’s vital oil infrastructure. This action comes after the recent reopening of the Sharara oilfield, Libya’s largest, which had also experienced closures due to protests earlier in the year.

The situation underscores the challenges faced by Abdelhamid Dbaiba, the interim Prime Minister of the Government of National Unity (GNU), in maintaining stability within the country’s oil sector.

The PFG has stated their demands are focused on securing their legal rights and have emphasized their non-political agenda. They expressed their frustration over unfulfilled promises by Libyan officials, including those from Prime Minister Dbaiba aimed at resolving the group’s financial grievances.

The Libyan National Oil Company (NOC) notes that the country’s refineries have a combined processing capacity of approximately 380,000 barrels per day, with the Al-Zawiya facility processing 120,000 bpd alone.

The series of disruptions, including the shutdown and declaration of force majeure at the Sharara oilfield earlier in the year, followed by another temporary closure, highlight the persistent volatility in Libya’s oil sector. These disruptions have significant implications for Libya’s economy and the global energy market.

The standoff at these facilities underscores the broader challenges of achieving stability in Libya, where the nation’s oil sector remains a critical economic resource amidst ongoing political and factional negotiations.

Since the fall of Moammar Gaddafi in 2011, Libya’s oil resources have been a focal point of conflict and negotiation, with control over these resources often leading to power struggles among various factions and regions. The current situation with the PFG reflects the ongoing instability affecting the country, where economic assets such as oil are frequently central to political and financial disputes.