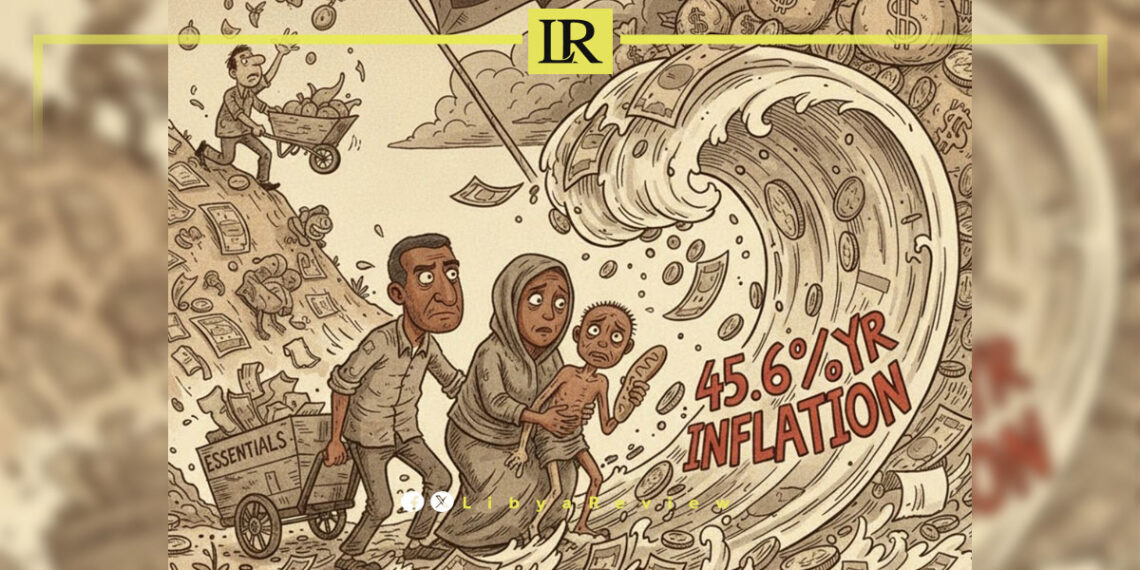

US economist Steve Hanke has estimated Libya’s annual inflation rate at 45.6%, placing the country fifth worldwide among nations with the highest inflation levels, according to figures he published on social media.

In a post on X, Hanke stated that Libya ranks as the fifth highest country globally in terms of inflation, describing the Libyan economy as being “in a state of collapse.” Hanke, a professor of applied economics at Johns Hopkins University, is known for issuing independent inflation estimates, particularly for countries experiencing monetary instability, exchange rate volatility, or gaps in official economic data.

His estimate comes amid growing economic pressures in Libya, including fluctuations in the value of the Libyan dinar, rising living costs, and ongoing institutional divisions that affect fiscal and monetary coordination. Exchange rate instability, especially in early 2026, has contributed to noticeable increases in the prices of imported goods and basic commodities, fueling public concerns about purchasing power.

However, Hanke’s 45.6% figure contrasts sharply with projections released by international institutions. Forecasts for Libya’s inflation rate in 2026 generally range between 1.5% and 1.9%, while early first-quarter estimates suggest inflation may have reached around 3.5% due to exchange rate pressures and supply constraints.

The significant gap between Hanke’s estimate and institutional projections has sparked debate among economic observers. Analysts point out that inflation measurement in Libya can be complicated by factors such as parallel market exchange rates, subsidy distortions, limited transparency in statistical reporting, and differences in calculation methodologies.

Libya’s economy remains heavily dependent on oil revenues, making it vulnerable to external shocks and currency volatility. Political fragmentation and competing fiscal authorities have also added complexity to economic management, often slowing reform efforts and policy coordination.